Micro E-Mini Futures FAQs

Related Articles:

When will the Micro E-Mini products be listed for trading?

CME Group will launch the following futures contracts on May 6th.

- Micro E-mini S&P 500 futures

- Micro E-mini Nasdaq-100 futures

- Micro E-mini Dow futures

- Micro E-mini Russell 2000 futures

Why is CME Group choosing to launch these products?

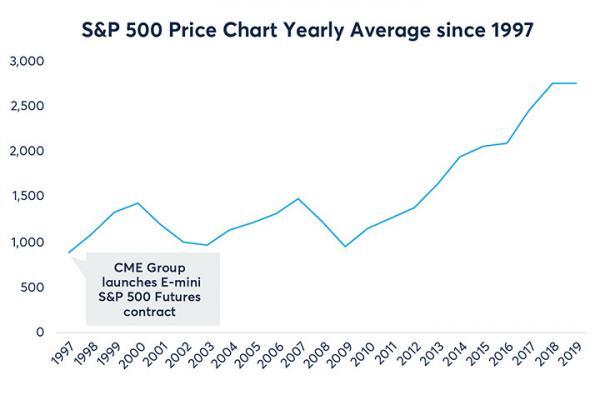

Since the launch of the E-mini product suite in 1997, the notional value of these contracts has increased dramatically. As a reference, see the price chart of the S&P 500 since its launch in 1997.

The notional value of the E-mini S&P 500 futures contract has increased from ~$47K on the date that it launched to ~$145K on April 22, 2019. The amount of capital needed to access the futures market has become too burdensome for many individual traders. To make our more market accessible to all, CME will launch the Micro E-mini suite of futures, which feature multipliers 1/10 the size of their E-mini counterparts (i.e. $5 multiplier for Micro E-mini S&P 500 futures contract vs. $50 for E-mini S&P 500 (ES) futures).

What are the differences between the currently listed E-mini products and the recently announced Micro E-mini products?

| Index Family | Micro E-mini Multiplier | E-mini Multiplier |

|---|---|---|

| S&P 500 | $5 | $50 |

| Nasdaq-100 | $2 | $20 |

| Dow Jones | $0.50 | $5 |

| Russell 2000 | $5 | $50 |

What are the contract specifications?

Micro E-mini futures will be listed on the customary U.S. Equity Index futures cycle – there will be five concurrent futures that expire against the opening index value on the third Friday of March, June, September and December. The tick increments will follow their E-mini counterparts as follows:

| Index Futures Contract Specs | Outright | Calendar Spread |

|---|---|---|

| Micro E-mini S&P 500 futures | 0.25 Index points= $1.25 | 0.05 index points= $0.25 |

| Micro E-mini Nasdaq-100 futures | 0.25 Index points= $0.50 | 0.05 index points= $0.10 |

| Micro E-mini Dow futures | 1.00 Index points= $0.50 | 1.00 index points= $0.50 |

| Micro E-mini Russell 2000 futures | 0.10 Index points= $0.50 | 0.05 index points= $0.25 |

What are the codes for these products?

| Index Futures Contracts | CME Globex | Firetip X |

|---|---|---|

| Micro E-mini S&P 500 Futures | MES | MES |

| Micro E-mini Nasdaq-100 Futures | MNQ | MNQ |

| Micro E-mini Dow Futures | MYM | MYM |

| Micro E-mini Russell 2000 Futures | M2K | M2K |

How many contracts will be listed at a given time?

There will be five months listed in the March Quarterly Cycle (Mar, Jun, Sep, Dec) for Micro E-mini S&P 500, Nasdaq-100 and Russell 2000 futures.

Dow Micro E-mini futures will list four months.

What are the trading hours on CME Globex and ClearPort?

Sunday – Friday 6:00 p.m. – 5:00 p.m. ET with a trading halt from 4:15 p.m. – 4:30 p.m. ET

How are the daily settlement price Micro E-mini futures determined?

Daily settlement for Micro E-mini futures are based on the 30-second volume-weighted average price (VWAP) of CME Globex trades between 4:14:30 p.m. and 4:15:00 p.m. ET of their E-mini counterpart.

How are final settlement prices of the futures determined?

The Micro E-mini will have the same SOQ value as the corresponding E-mini contract on final settlement day. Final settlement value is based on the Special Opening Quotation (SOQ) on the third Friday of the contract month. The SOQ is based on the opening price of each component stock in the relative index, regardless of when those stocks open.

Are these futures contracts eligible for block trading or BTIC?

No, Micro E-mini Equity Index futures contracts will not be block or BTIC trading eligible.

What are the margin requirements for Micro E-mini Index futures?

Margins are indicative of their E-mini counterparts and the below estimates are based on current market conditions and are subject to change.

| Initial | Maintenance | Futures Price | Multiplier | Notional Value | |

|---|---|---|---|---|---|

| MES | 690 | 630 | 2912.5 | 5 | 14562.5 |

| MNQ | 836 | 760 | 7734.75 | 2 | 15469.5 |

| MYM | 649 | 590 | 26513 | 0.5 | 13256.5 |

| M2K | 391 | 355 | 1564.1 | 5 | 7820.5 |

What are the available margin credits for offsetting positions between the Micro E-mini Index futures and CME Group’s major U.S. benchmark index futures?

Margins credits are indicative of their E-mini counterparts and the below estimates are based on current market conditions and are subject to change

Micro E-Mini Equity Index Futures Margin Offsets:

| MES | MNQ | MYM | MRT | |

|---|---|---|---|---|

| MES | x | 1:1 (75%) | 1:6 (85%) | 2:15 (80%) |

| MNQ | 1:1 (75%) | x | 3:5 (55%) | 2:3 (70%) |

| MYM | 6:1 (85%) | 5:3 (55%) | x | 2:3 (70%) |

| MRT | 15:2 (80%) | 3:2 (70%) | 3:2 (70%) | x |

Learn More about Margins

Are Micro E-mini products fungible with their E-mini counterparts? Can they be offset?

Yes, Micro E-mini futures are offset eligible versus their E-mini counterparts at 10:1 ratio. This can only be applied to offsetting positions. Request can be made by your clearing broker directly to CME Clearing.

Additional Information

Will there be on-screen market makers for the Micro E-mini products?

CME Group plans to introduce a market maker program to assure continuous two-sided markets are quoted on-screen throughout the trading day starting on launch date.

How can I see prices for Micro E-mini Index futures?

You can view quotes through any of our offered Trading Platforms.

What trade matching algorithm will be used for the Micro E-mini futures on Globex?

Micro E-mini futures will use FIFO (First in, first out) algorithm, identical to their E-mini counterparts.

What are the fees for Micro E-mini contracts?

Micro E-mini S&P 500, Nasdaq-100, and Russell 2000 products will be part of the Micro E-mini Equity Index futures suite according to the CME Fee Schedule.

Micro E-mini Dow will be part of the Micro E-mini Equity Index future suite according to the CBOT Fee Schedule.

Please note the above relates to CME clearing fees. Commissions, clearing, NFA, and other fees may apply.

Are there circuit breakers on Micro E-mini products?

CME Group U.S. Equity Index price limits (and corresponding CME and CBOT rules) are designed to coordinate with circuit breakers provisions as applied by the New York Stock Exchange (NYSE). Micro E-mini contracts will follow the same rules as their E-mini counterparts.

- 7%, 13%, and 20% price limits are applied to the futures fixing price and are effective from 8:30 a.m. CT – 3:00 p.m. CT. Mondays through Fridays. This only applies to the downside.

- 5% up-and-down limits are effective 5:00 p.m. – 8:30 a.m. CT. Sundays through Fridays; and 3:00 p.m. – 4:00 p.m. CT, Mondays through Fridays. Between 3:00 p.m. – 4:00 p.m. the 5% price limit will not be allowed to breach the 20% daily limit.

If you have additional questions, feel free to contact us or leave a comment.

Live Demo of the Ironbeam trading platform

Sign up for a FREE 14 day trial of the Ironbeam futures trading platform

Please note that the demo does not account for commissions and fees that would be charged in a live account.

DISCLAIMER: There is a substantial risk of loss in trading commodity futures and options products. Losses in excess of your initial investment may occur. Past performance is not necessarily indicative of future results. Please contact your account representative with concerns or questions.

Information was gathered from an independent 3rd party, and while the information is believed to be reliable, Ironbeam is not responsible for inaccuracies.

Don’t really see the point for trading these… The brokerage commissions / fees / all in etc. will still be the same, except with the smaller contracts profitability would drop by 90%. So same high costs, much reduced profitability. Could be good for new traders to get their feet wet I guess.

Hi Mr. Carr,

The fees are actually a little bit lower. For example, the exchange fee for an E-Mini S&P is $1.18 per side, while the Micro E-Mini S&P exchange fee is only $.20/side. It’s hard to say how popular these will be before they start trading, but we see these as being very useful for options hedging, as well as position/swing trading, since the capital requirement is much lower as well as the leverage.

How much is going to be a deposit to open an account to trade Micro ES?

Hello,

We do not have account minimums. The margins for the Micro Eminis are around $700 at the moment. For day trading, we offer margins as low as $50 on these contracts.

Is IB planning to start futures trading tutorials?

Hi PK,

We don’t currently have futures trading tutorials, however there are some great free resources out there for beginner traders. Send us an email and we can point you in the right direction.

Where can I get the ticker for the micro=E=minis. Do you accept accounts from Canadians. What is the minimum to open the account. What are your commissions for stocks , futures and options.how can I try your platform

Hi Jude,

I recommend getting a demo of Firetip X. You can sign up for a demo on our home page HERE. We do not have account minimums, and you can find more information on opening an account and commissions HERE.

What’s the charge after the 14 day trial to keep using the platform. Also I’m trading one contract .if I’m reading this right it’ll be $0.40 in and out per side 1 contract. On the previous posted messages. Regards

Ismael,

The Firetip X trading platform is completely free to new accounts for the entire year of 2020. As for commissions, please give us a call, as fees vary by product. 312-765-7200.

how much a round turn all in for you guys?

Thomas,

For a detailed commission breakdown, please call us at 312-765-7200 or send an email to [email protected]

HI,

How much you guys charge for commission after the 30 days promotion period?

Tommy,

Commissions are dependent on a few things. Please shoot us an email or give us a call for a quote. The lowest commission we currently offer on the Micros are 25 cents per side.

how much funds do i need to trade future and commissions please

Nyan,

Feel free to call and speak to a licensed rep to discuss commission rates. We do not have account minimums.

I have ninjatrader lifetime license. Can I use it here?

Owin,

You can use a lifetime Ninja license here if you purchased it prior to March of 2015.

Can we use CQG here?

Hi Achille,

Yes, you can. You can view a list of popular trading platforms here: https://www.ironbeam.com/trading-platforms.

Hi, is it possible to trade fractions, like sizing 3.45 contracts of Micro E-mini Nasdaq-100 Futures for example, or has to be always integers: 1, 2, 3… 10 etc

Hey there,

It is not currently possible to trade fractions of futures contracts.