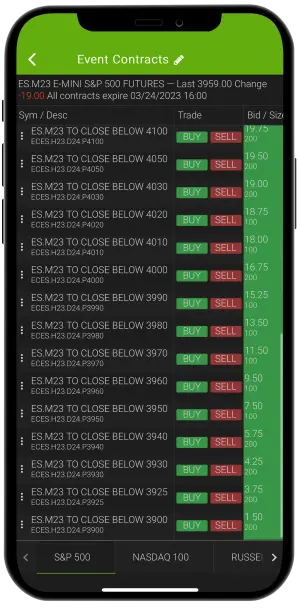

Traders can use Ironbeam’s streamlined Event Contract trader to pick a side on key futures markets on a daily basis.

Through event contracts, you can express your opinion on whether the prices of important futures markets will increase or decrease by the close of each trading session. The available options comprise CME-listed event contracts for Equity Index, Energy, Metals, and Foreign currency futures markets. To trade, all you have to do is select YES or NO for an event contract.

Ironbeam has the tools and data you need to trade futures and options effectively, including an easy-to-use trading platform, dedicated futures specialists, educational resources, and 24 hour support.

Disclaimer: Although the Ironbeam trading platform is offered at no charge, commission, exchange, and NFA fees still apply.

The world of futures trading can be both exciting and rewarding, but it also involves taking calculated risks. At Ironbeam, we understand that every trader is unique—so we don’t impose an account minimum. This is part of our commitment to offer a flexible trading experience. However, we do have some recommendations to help you trade more effectively […]

READ MOREA Comprehensive Guide As the world of futures trading becomes more complex and competitive, traders are constantly seeking ways to gain an edge. One tool that has proven invaluable for this is Level 2 data. Unlike Level 1 data, which provides basic information like bid and ask prices, Level 2 data delves deeper into the market’s inner […]

READ MORELegal Disclosures and Full Disclaimers | Privacy Policy

DISCLAIMER: There is a substantial risk of loss in trading commodity futures and options products. Losses in excess of your initial investment may occur. Past performance is not necessarily indicative of future results. Please contact your account representative with concerns or questions.

Copyright © 2012-2023 IRONBEAM | All Rights Reserved