Understanding Level 2 Data in Futures Trading

A Comprehensive Guide

OPEN ACCOUNTAs the world of futures trading becomes more complex and competitive, traders are constantly seeking ways to gain an edge. One tool that has proven invaluable for this is Level 2 data. Unlike Level 1 data, which provides basic information like bid and ask prices, Level 2 data delves deeper into the market’s inner workings. This guide aims to demystify Level 2 data and explain its critical role in futures trading.

1. What is Level 2 Data in Futures Trading?

Level 2 data in futures markets shows real-time bids and offers at various price levels, beyond just the best bid and best offer. This depth-of-market view enables traders to understand where the supply and demand are concentrated, giving insights into potential price movements.

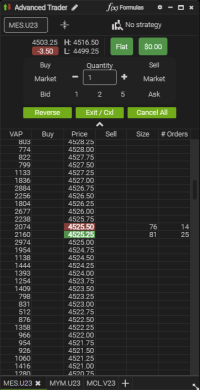

This snapshot captures the DOM displaying Level 1 data for the MES futures contract. You’ll see just the best bid and best ask prices at this level.

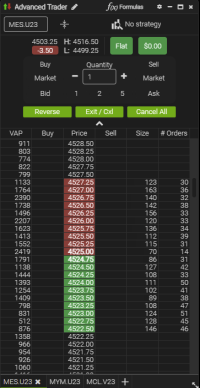

This image dives deeper into the DOM by showcasing Level 2 data for the MES futures contract. Unlike the Level 1 view, here you see multiple layers of bids and asks at different price levels.

2. Why Level 2 Data is Crucial in Futures Trading

- Insight into Market Depth: Level 2 data allows traders to see where significant buying or selling interest lies in the futures market, thereby providing clues about potential price movements.

- Identification of Resistance and Support Levels: Accumulations of buy or sell orders at specific price levels often act as potential resistance or support levels in futures markets.

- Fine-Tuning Entry and Exit Points: The visibility of pending orders at multiple price levels can aid traders in selecting more precise entry and exit points.

3. The Components of Level 2 Data in Futures

A typical Level 2 screen in futures trading will display:

- Bid Prices and Sizes: These are the prices and quantities at which traders are willing to buy a specific futures contract.

- Ask Prices and Sizes: These are the prices and quantities at which traders are willing to sell the contract.

- Market Participants: While Level 2 data in stock trading often shows market makers, futures Level 2 data primarily displays individual traders, hedge funds, and institutional investors placing orders.

4. Effective Usage of Level 2 Data in Futures Trading

While Level 2 data offers invaluable insights, it’s not a magic bullet. Here are some tips for using it effectively:

- Combine with Other Tools: Level 2 data should be used in conjunction with other forms of analysis, like technical and fundamental analysis, to validate trading decisions.

- Watch for Order Size: Large orders can often influence price direction but be cautious; sometimes large orders are split into smaller chunks to mask a trader’s true intent.

- Understand Market Conditions: The effectiveness of Level 2 data can vary depending on market volatility. During high volatility periods, Level 2 data can change rapidly, so quick decision-making is essential.

5. Accessing Level 2 Data for Futures Trading

Access to Level 2 data usually requires a subscription through your trading platform. Platforms specializing in futures trading, like the Ironbeam futures trading platform, often offer Level 2 data as a part of their trading tool suite, ensuring that traders have all the information they need at their fingertips.

Conclusion

Level 2 data offers futures traders a profound insight into market depth and potential price direction. By understanding the layers of buy and sell orders in real-time, traders can make more informed decisions, from identifying likely support and resistance levels to fine-tuning entry and exit points. Though it should not be used in isolation, Level 2 data is an invaluable tool for those looking to navigate the complexities of futures markets successfully.

Ready to trade?

OPEN ACCOUNTDISCLAIMER: There is a substantial risk of loss in trading commodity futures and options products. Losses in excess of your initial investment may occur. Past performance is not necessarily indicative of future results. Please contact your account representative with concerns or questions.

One comment