Designed specifically for day traders of futures and exchange traded spreads, the daytradr platform is a robust stand-alone multi-threaded trading platform that connects to Ironbeam via Rithmic and CQG. Daytradr contains all the features from the popular plug-in and IQFeed. Daytradr contains all the features from the popular plug-in from Jigsaw (used by over 4,500 traders) and much more, to deliver a fantastic futures trading experience.

Jigsaw’s award winning tools can integrate to your existing trading platform. The Jigsaw Platform Bridge allows Daytradr to connect directly with the MetaTrader 5 platform as well as MultiCharts.NET and MultiCharts.NET SE.

Jigsaws “LTF” Charts is an innovative full charting package made to work “out of the box” with minimum need for user settings or complex setup. Jigsaw added traditional charts to their Order Flow package in response to tightening of regulations by the CME that sees your data fees increase dramatically if you connect from 3 or more apps. This is a charting tool for traders, it is not meant to be a huge and complex tool with thousands of options per chart and indicator.

Learning to trade or learning a new strategy is problematic on most trade platforms. Unless you are trading live, with real money – you’ll never know how realistic the results are. That’s because most platforms take an optimistic view on the prices you’d be filled at. Jigsaw daytradr is different – it is developed to give you more realistic fills on Limit Orders and realistic slippage on Market and Stop Orders.

The Depth & Sales is Jigsaw’s interpretation of the Depth of Market (DOM). A tool that is the cornerstone of the proprietary trader’s decision making process. It is here we see the interaction between passive traders (limit orders) and active traders (market orders).

The Depth & Sales shows:

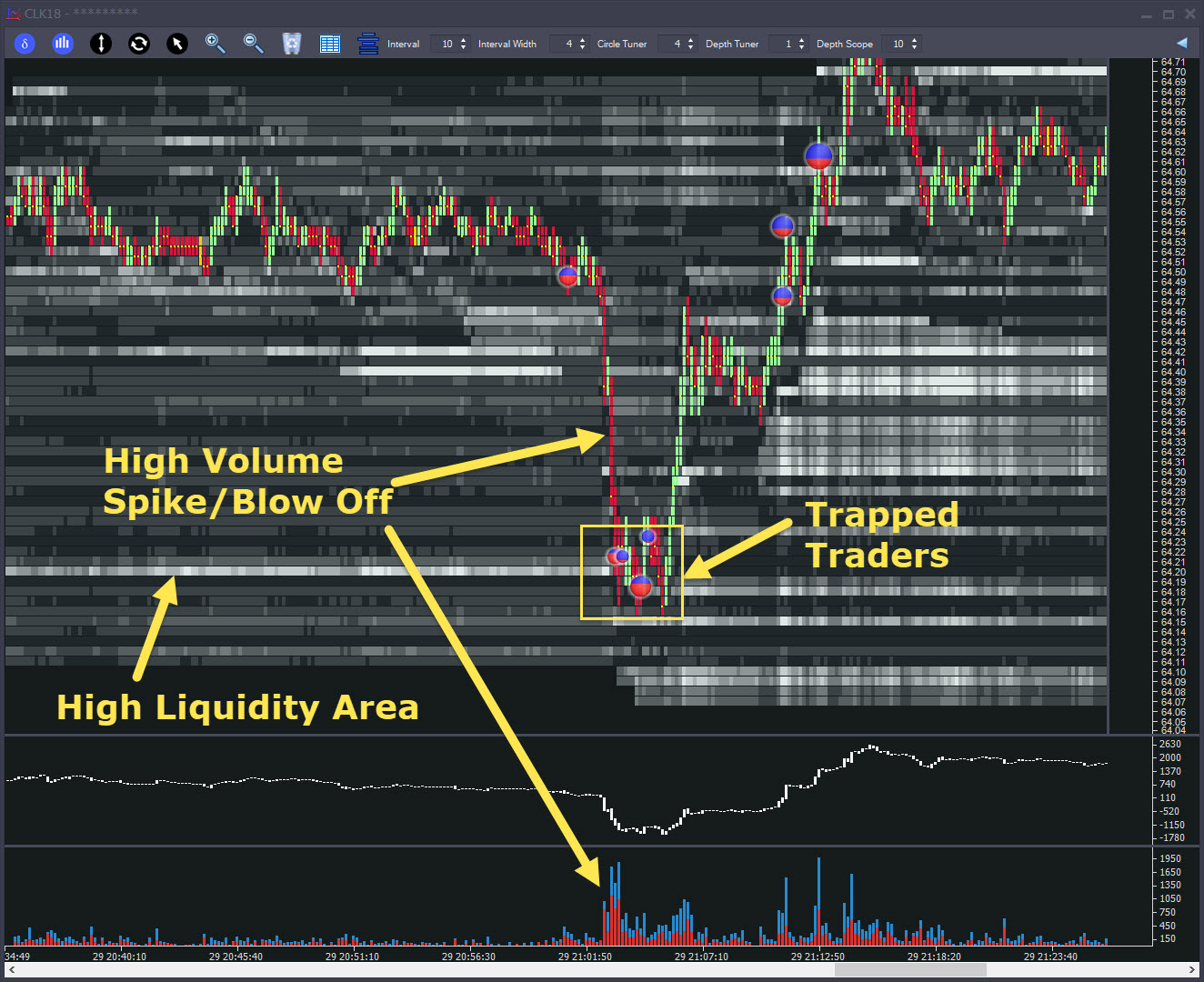

Auction Vista gives a detailed view of both real time and historical order flow. An extremely accurate ‘self tuning’ view with very few settings required to get the most from it.

Legal Disclosures and Full Disclaimers | Privacy Policy

DISCLAIMER: There is a substantial risk of loss in trading commodity futures and options products. Losses in excess of your initial investment may occur. Past performance is not necessarily indicative of future results. Please contact your account representative with concerns or questions.

Copyright © 2012-2023 IRONBEAM | All Rights Reserved