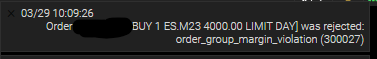

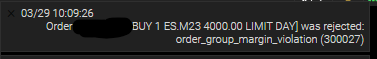

Getting this message when trying to place an order. Anyone know why?

This is on the Ironbeam platform.

Getting this message when trying to place an order. Anyone know why?

This is on the Ironbeam platform.

Hey there,

The rejection message you are receiving indicates that you do not have enough buying power in your account to satisfy the margin requirements of the order. Please double-check that your current account balance covers the day margin for the order in addition to any open positions or working orders that you have placed.

If you have any other questions please feel free to reach out.

Mike Murphy

[email protected]

But my stop-loss didn’t activate because of this and also now I can’t close my current positions for the same reason even with market orders??

Alan,

For an immediate trade-related issue like this, please call our trade desk at 312-765-7250. Please be aware that stop orders occupy margin. Please take this into account during your trading and when deciding on how much funds to keep in your account.

Mike Murphy

[email protected]

Hi Mike,

I use bracket orders quite a bit (actual order, stop loss and profit target), does this mean that I need to have 3x my actual order margin requirements?

To ask it another way, do I need to have the equivalent margin for the conditional legs of any order I place?

It’s a little concerning that Alan (as stated above) couldn’t close his order even with a market order.

Let us know. Thanks

@Stockdaddy the exchange takes your orders, calculates the worst case scenario in terms of what orders can be filled, and calculates the margin based off of that. That is why its important not to trade with the bare minimum day margin amount and keep your account well capitalized for futures trading, in addition to the inherent risks of trading a highly leveraged product.

The other user in question had other orders working at the time they were trying to exit via a market order.

Example: If you have a sell stop for 2 contracts, and then submit a market order for one, of course the margin required for that is going to be higher than what would be required to simply offset an open position with a market order, while no other orders are working, because all three orders can be filled and result in a higher margin position. The exchange and broker is not in the business of assuming your intention with your orders, they simply calculate the orders and positions as a whole.

Mike Murphy

[email protected]

So I’m clear then, every “working order” regardless of the scenario will be the total contract count multiplied by the margin required per contract, correct?

From my example, if I place a bracket order for (1) ES contract that has a two point stop loss and a 10 point profit target, I would need $1,500 in margin to cover the three positions.

Am I thinking through this correctly?

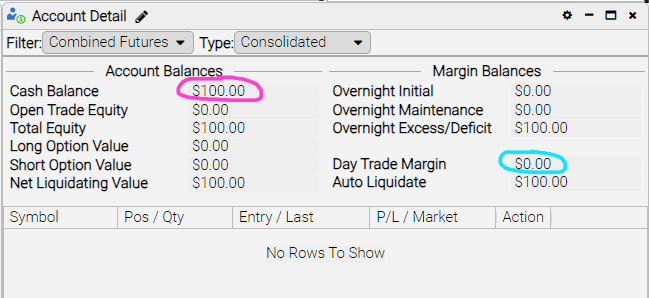

I just got off a call with Ironbeam, short wait and knowledgable rep. My particular issue is just that ACH hasn’t cleared. In my account, I see a cash balance but it doesn’t list anything for “Day Trade Margin” in the account window on the Ironbeam web platform. That’s because ACH hasn’t fully cleared yet so I’m just waiting. From what I was told by the rep there MUST be a Day Trading Margin balance, mine will show once my ACH finalizes. So if you did wire transfer I’m assuming it’ll show a day trading balance the same day. It was curious because my balance doesn’t show anything for overnight margin either, my $100 shows up only in the “Overnight Excess/Deficit” line item. So in my case it’s simply waiting for accounts to settle.

From what I was told, once the TOTAL account balance goes below 50% of starting capital, Ironbeam auto liquidates. This is exactly what I wanted since I wanted about a $50 buffer to test the waters with a single MES. Not sure how this affects anyone else, make sure to check the liquidation procedure because it could apparently close your position if you hit a 50% total drawdown. I need to review it myself.

In any case, if I have it right, $50 should be enough to open and close a single MES. From what Mike said it sounds like they do intelligent margin calculations (which I would assume lol but it is technically an assumption) so to reduce shouldn’t require more margin.

Not sure what happened with OP’s situation so let’s see if I have that right as well. From what I gather, other stop orders were in place, which would reserve capital for margin. 2 short stops would reserve $100 on the MES, so if for example you entered an early market exit for one of those stops, then yes I can see a margin calculation being exceeded. Let’s say you are long one and set two stops short. If both stops are hit you’re now net short one. If you tried to place a market short pre-emptively, your max short position of two contracts would exceed your capital if you only had $80 in your account. So while in this position, you have to close one of the limits before placing a market short. I can see it being an issue when the stops are set up as a reverse, as one example.

Pretty sure I’ve got all that right, hopefully that helps clarify. Please let me know if I’m wrong, details are kinda important lol.

I get it if there are no calculations, only margin requirements for all order types. Understandable from a backend complexity standpoint. Just wanting to make sure because I traded bitcoin for 2 years and I’ve been trading with Apex for about 6 months now and this is my first cash futures account. Wanting to make sure because I’ve never been unable to close a position before.

If this is the case, that’s fine, and my only issue would be that it’s kinda false advertising to say $50 intraday margin when even $100 isn’t cutting it for a single MES order.

I would love some clarification on this. I can’t buy a single MES and I have $100 in my account. I’m trading with Apex trader right now, all I’m trying to do is market buy 1 MES and then close it out. I’m getting the same error, insufficient margin. The margin is supposed to be $50 for 1 MES intraday. That should mean I can market buy 1 MES and market sell it with $100 in the account. I have double the intraday margin required. Are we saying we can’t close an open position with a market order if we don’t have enough margin? That’s absurd, more margin shouldn’t be required when REDUCING risk. Please tell me Ironbeam doesn’t calculate based on max number of positions but rather max possible risk, because bracket orders are 3 orders but max risk is 1/3 of that, the open position will be closed on hitting TP or SL. There’s only one contract, one open position at a time, it would be ridiculous to require 3x the margin on a bracket order.

I should be able to limit or market close part or all of a position with the same margin required to open the position. It’s that simple. Otherwise I could get stuck in a situation where I can’t close and I refuse to believe Ironbeam allows situations in which their clients can’t close a position.

So are we saying here that Ironbeam calculates NONE of the risk and assumes ALL order types require margin? That would be absurd. A limit order requires no margin until it gets filled. Anyway, just trying to clarify here. If this is the case then it’s good to know before opening if one could be unable to close a position.

@130rne You should really call the trade desk in this scenario. We can’t help with account-specific issues in this forum. The ‘Day Trade Margin’ field is a usage field. If you have a position of 1 MES, the Day Trade Margin will show $50. Since you have no positions on, it shows $0.

It sounds like your funds are still not cleared, considering that you can’t trade an MES. Try not to overthink the margin usage for a bracket order. It is simple. Take the worst case position from your orders and that is the margin required.

Mike Murphy

[email protected]

That was indeed the case with mine, my funds hadn’t cleared. I’m able to trade a single MES now. Thanks for the reply.

Worst case is the answer, for anyone browsing this thread, not total number of orders. My example hightlights a situation in which this could be an issue. Short answer, close limit orders first to free up allocated margin if trying to use market orders.

So no, @Stockdaddy you are thinking total number of orders. Ironbeam calculates the maximum position size possible for what you’re trying to do. So if you’re trying to submit a market short, assume all your limit shorts get filled immediately after, which is technically possible if all the orders shift. That’s worst case and is what your margin requirements are based on. A single bracket order is one open contract, and either the TP or SL will flatten the position, so in that case only 1x margin is required.

HTH

Thanks, that’s what I was hoping was the answer.

Needing margin for conditional order that may never trigger would certainly be a strange approach.

Do you all have the 50% auto liquidation, what bugs me is that I wasn’t told about it till I opened my account and saw it, it kind of increases the margin requirement if you think about since you need 50% of your account to open any position if you have a large account, but if you have a 100$ account it shouldn’t matter since the margin is 50$.

Hello,

It does not increase your margin requirement. You can still use the full buying power of your account. Futures are inherently highly leveraged, and even more so in with day margins. You will be pressed to find a broker offering day margins that does not have a liquidation threshhold.

Mike Murphy

[email protected]

DISCLAIMER: There is a substantial risk of loss in trading commodity futures and options products. Past performance is not necessarily indicative of future results.

Copyright © 2012-2023 IRONBEAM | All Rights Reserved