Levels R3 - R6, Cy1, and levels S3 - S6 are helpful as rare leading indicators before the day begins - supplying key reversal or decision levels.

Ideally the gadget would default to looking up the prior day’s O,H,L,C. These prices would also be available to plot with Camarilla levels across all intra-day charts too.

Ref = 1.1*(H-L)

R6 = R5+(1.168*(R5-R4))

R5 = R4+(1.168*(R4-R3))

R4 = C+(Ref/2)

R3 = C+(Ref/4)

============== R2 = C+(Ref/6)

============== R1 = C+(Ref/12)

Mid = Prior Day Close

============== S1 = C-(Ref/12)

============== S2 = C-(Ref/6)

S3 = C-(Ref/4)

S4 = C-(Ref/2)

S5 = S4-(1.168*(S3-S4))

S6 = S5-(1.168*(S4-S5))

Where S6 and R6 follow the expanding volatility logic of S5 and R5.

The levels between S3 and R3 are traditionally considered less significant, but can serve as partial targets on the way to a crossing between S3 and R3.

Traditional Pivot: (H+L+C)/3 and weekly H & L may also be plotted on all time frame charts if available in this same Camarilla gadget.

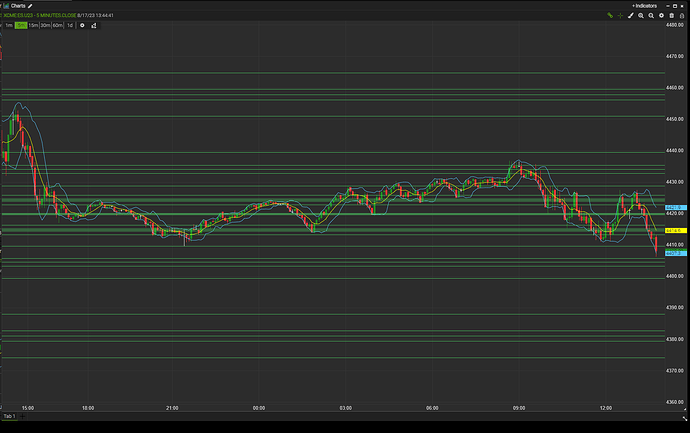

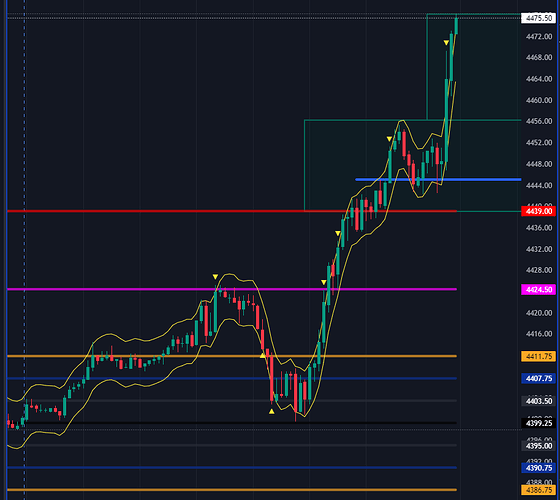

Today’s Camarilla levels so far. (230817) I’m temporarily using the kludge of “Retracement Lines”, so just ignore, if you can, the 3 Fib lines in the middle of each bracket pair.

When rectangle capacity arrives, I would place each Camarilla bracket pair, down from the top, in its own uniquely colored rectangle, for better clarity.

So we’d have the 4 major bracket rectangles: R6-R5, R4-R3 and S3-S4, S5-S6. and then the 2 minor bracket rectangles of R1-R2 and S1-S2. User could deactivate any brackets not needed for a current days planned trades.

Note the market so far today has crossed the 20 point span twice - between S3 to R3 and then R3 to S3, some what respecting these reference levels today, as it usually does.